After completing a strategic review of its cancer therapeutic and cancer diagnostic assets, Cellectar Biosciences (NASDAQ:CLRB) has refocused the company on its phospholipid ether drug conjugate (PDC) platform and cancer-targeting delivery of oncologic payloads.

“We were previously focused on advancing our diagnostic assets, with no plan to take advantage of our cancer therapeutics beyond radiotherapeutics,” newly appointed president and CEO, Jim Caruso, says in an interview with BioTuesdays.com.

“We believe our PDC platform has the potential for significant value creation and as a result, we plan to seek collaborators to complete development of our diagnostic imaging agents,” he adds.

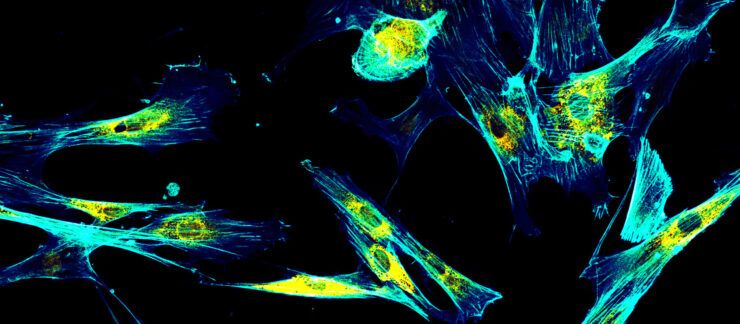

Mr. Caruso, who joined Cellectar in mid-June, explains that PDCs are proprietary small molecule, cancer-targeting delivery vehicles that consist of a cancer selective phospholipid ether, a linker molecule and a drug payload.

“PDCs are a new class of cancer targeting and delivery technology that have the ability to attach diverse oncologic payloads against a broad range of selective cancer and cancer stem cell targets, with the additional advantage of prolonged retention,” he contends.

He points out that PDCs are designed to enter cancer cells through the cell cytoplasm and are cancer selective, unlike antibody drug conjugates, which are biologics and target tumor-specific antigens at the cell surface.

“Our PDC cancer targeting has been validated, using cytotoxic radioisotopes for cancer therapy and imaging; fluorophores for imaging-guided surgery; and we now plan to demonstrate similar data with chemotherapeutics such as paclitaxel and gemcitabine, for an improved therapeutic index,” he adds.

The company’s PDC delivery platform has been peer-reviewed, most recently, in Neurosurgery in February 2015 and Science Translational Medicine in June 2014. The platform is protected by more than 28 patents issued or pending.

Cellectar’s lead in-house PDC radiotherapeutic is CLR 131. Its payload is the delivery of iodine 131, a proven cytotoxic radioisotope, which is used primarily for thyroid cancer.

Mr. Caruso says the company has demonstrated in vivo tumor uptake, retention and efficacy with CLR 131 in liquid and solid tumors. “We are expanding the indications beyond thyroid cancer and believe we have a very good shot on goal with CLR 131 against multiple myeloma,” he contends.

Multiple myeloma is the second most common hematologic cancer, with a prevalence of about 90,000 patients, an incidence of about 27,000 patients, of which some 13,000 are relapse/refractory patients with limited options resulting in a clear unmet medical need.

CLR 131 for relapsed/refractory multiple myeloma has been granted orphan drug designation and has the potential for fast track, breakthrough therapy and accelerated approval.

Mr. Caruso says CLR 131 has the potential for single dose treatment, which is significant in the relapsed/refractory market.

Cellectar initiated an open label, Phase 1 dose escalation trial in the second quarter this year. It expects to evaluate a minimum of three patients in the first cohort during the first half of next year and initiate cohort 2 also during the first half of 2016.

The primary objective of the trial is dose-limiting toxicity, with secondary objectives to determine a Phase 2 dose and low dose efficacy read.

Cellectar’s PDC chemotherapeutic program currently includes two preclinical drug candidates: CLR 1601-PTX, with paclitaxel as the payload, and CLR 1605-GEM, with gemcitabine as the payload.

Mr. Caruso says the company has in vitro studies that demonstrate CLR 1601-PTX’s stability and cytotoxic activity. Preclinical data for CLR 1601-PTX will be updated in the fourth quarter this year and CLR 1605-GEM in the first quarter next year.

“Our objective with this program is to develop chemotherapy PDCs with improved efficacy and tolerability,” he contends.

From a clinical rationale, he suggests there are numerous chemotherapies that are highly effective yet are highly toxic that could be improved through a PDC targeted delivery.

And from a business rationale, he points to a significant opportunity through clinical development partnerships to create new products, with new patent life and life cycle management.

“There are many companies with therapies that offer great promise but their tolerability has not allowed them to be advanced through the clinic. Our targeting delivery platform may give those molecules a shot on goal,” he points out.

In its cancer diagnostic program, Cellectar is evaluating value-optimizing pathways for its optical imaging and PET/CT imaging compounds. “In the past, we haven’t aggressively shopped these assets but we now plan to reach out to potential partnership candidates who could develop these compounds,” Mr. Caruso says.

While Cellectar is building its future around CLR 131 as a treatment for multiple myeloma and using its PDC platform to create partnership opportunities, Mr. Caruso says the company reserves the right to advance one or more of its cancer therapeutic products at least through Phase 1 development.

“Our team is focused on a plan to unlock the value of our PDC platform by developing wholly-owned therapeutics, expanding cytotoxic therapeutic windows and advancing our platform through collaborations,” he adds.