By Melane Sampson

Conavi Medical (TSXV:CNVI) is leveraging its recent reverse merger (RTO) with Titan Medical to accelerate the wide-spread adoption of its breakthrough imaging platform, the next-generation Novasight Hybrid System, designed for use by interventional cardiologists during percutaneous coronary interventions (PCIs).

“Accessing the public capital markets through our planned, strategic amalgamation with Titan Medical last month marked a pivotal moment in Conavi’s evolution, enabling us to strengthen our financial position, fuel our growth strategy, and fully leverage the potential of our Novasight hybrid imaging technology across the U.S. and internationally,” Thomas Looby, CEO of Conavi Medical, says in an interview with BioTuesdays.

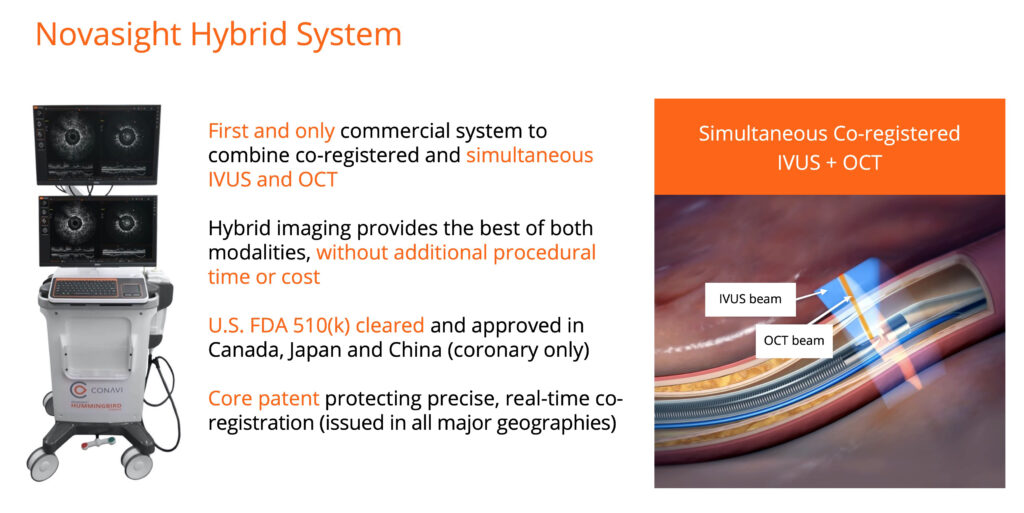

Conavi’s next-generation Novasight Hybrid intravascular imaging platform enables simultaneous intravascular ultrasound (IVUS) and optical coherence tomography (OCT) imaging of coronary arteries with a single catheter, providing a more cost- and space-effective option for intravascular imaging equipment.

“Novasight is truly groundbreaking technology, enabling physicians to see inside coronary arteries during PCIs compared to traditional angiography (x-rays), where visualization is limited to blood flow and interpretation can often be ambiguous,” Mr. Looby says.

The Novasight Hybrid System has received FDA 510(k) clearance and regulatory approval for clinical use from Health Canada, China’s National Medical Products Administration, and Japan’s Ministry of Health, Labor, and Welfare.

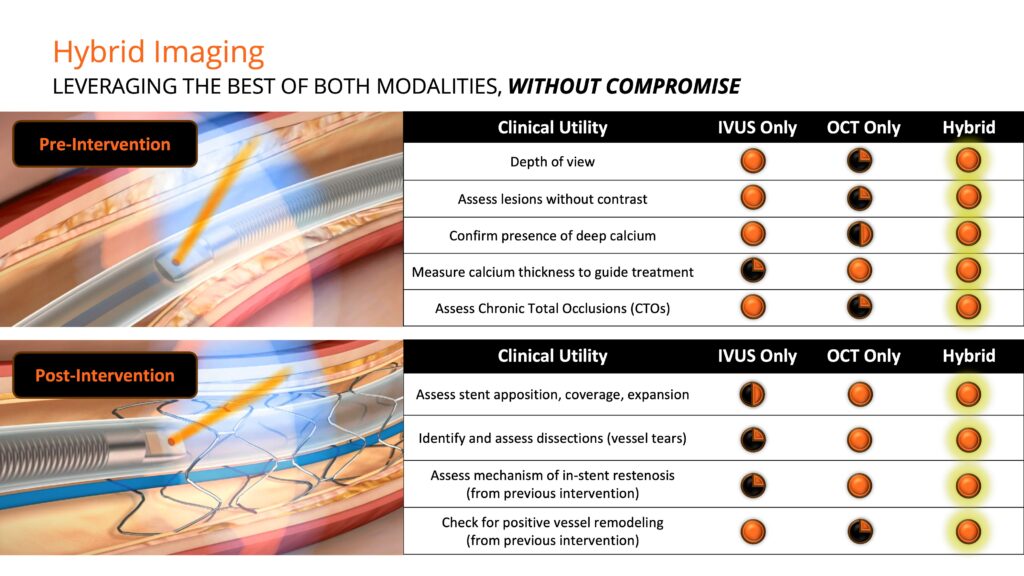

Mr. Looby explains that Novasight is the first and only commercially available system that combines the penetration and blood field compatibility of sound waves with the resolution and lumen detail of infrared light. Conavi’s patented imaging system is co-registered, meaning the IVUS and OCT beams physically overlap, allowing simultaneous imaging of the same cross-sections of tissue with both modalities in a single run.

“IVUS and OCT each have their own unique advantages, with IVUS allowing for reduction in contrast dye usage and greater depth of penetration and OCT delivering higher resolution images for enhanced visualization of the artery lumen and assessment of calcium thickness,” he adds.

Each year, more than four million coronary angioplasty and stenting procedures are performed globally, with most PCIs using only angiography. However, Mr. Looby noted that the adoption of newer intravascular imaging technologies, such as IVUS and OCT, is growing rapidly as a result of overwhelming clinical evidence supporting imaging to improve patient outcomes.

In a recent landmark guidelines update, the European Society of Cardiology (ESC) elevated IVUS or OCT to a Class 1A recommendation when performing PCIs and managing complex lesions, including left main bifurcations and long lesions.

The suggested standard of care, developed by the ESC task force or the management of chronic coronary syndromes and endorsed by the European Association for Cardio-Thoracic Surgery, is supported by the highest level of evidence. The announcement was made at the ESC 2024 Congress in London, UK, with the guideline updates published in the peer-reviewed European Heart Journal.

Although Conavi is not yet in the European market, Mr. Looby considers the ESC update a harbinger for similar changes likely to occur soon in the U.S., where current guidelines are at Class 2a. Historically, the U.S. has closely followed ESC standards. “The mounting clinical evidence can no longer be overlooked—it needs to be reflected in the guidelines,” he contends.

“We are enthusiastic about the growth of image-guided PCIs, a market developed by major players who have funded studies with compelling results that are driving the acceptance and adoption of image-guided versus angiography-only PCI procedures,” Mr. Looby says.

In an article published earlier this year, The Lancet reaffirmed the ESC findings, announced in August 2023, from 20 randomized, controlled trials of intravascular imaging-guided PCI compared with angiography-guided PCI involving 12,428 patients with chronic and acute coronary syndromes. These studies showed improved outcomes with intravascular imaging compared with angiography, reporting a 20% reduction in cardiac death, a 46% reduction in target vessel myocardial infarction, a 52% reduction in stent thrombosis, and a 29% reduction in reintervention.

“Our value proposition is that Novasight gives physicians the versatility of IVUS and OCT in one catheter and one mobile console while offering providers a cost-effective and space-saving solution at a comparable, single-use catheter cost,” Mr. Looby says. “There is no question in our minds that the future lies in image-guided interventions.”

The American College of Cardiology Interventional Council also advocates for intracoronary imaging as a routine part of clinical practice to assess lesions before intervention, prepare for stent deployment, and evaluate stent placement accuracy.

Health economics are also expected to drive new cardiology guidelines and reimbursement policies. For example, Mr. Looby mentions that the incremental cost-effectiveness ratio of IVUS, compared with angio-guided PCIs per quality-adjusted life year gained, has been shown to be $8,232 for complex PCIs and $12,730 for noncomplex PCIs.

“Moreover, medical students are now being trained in an imaging-first approach which will eliminate the need for additional education and reduce the learning curve for interpreting intravascular imaging IVUS and OCT images,” Mr. Looby contends. “Novasight, having both IVUS and OCT images side-by-side is also uniquely suited for aiding in this image interpretation education at teaching hospitals as proficiency in IVUS and OCT translates directly to its use.”

The current PCI market stands at more than $700 million with TAM valued at approximately $4 billion globally. “The intravascular imaging market has significant revenue growth potential as IVI methods advance and adoption among physicians continues to increase,” he adds.

Mr. Looby describes Novasight’s business model as a razor/razor blade strategy similar to industry leaders such as Abbott, Philips and Boston Scientific. Pricing for the Novasight console and single-use catheter is comparable to standalone IVUS or OCT offerings, with potential for a future premium.

Emphasizing Conavi’s phased commercial rollout, Mr. Looby highlights the pilot launch of Novasight 2.0 in the U.S. and the upcoming completion of Novasight 3.0 development in 2024 and 2025. “We have achieved most of our design goals for Novasight 3.0 and are now focused on FDA submission, global launch plans for early 2026, and ongoing clinical trials into 2027 to validate clinical utility for key applications.”

Currently, Novasight is approved for coronary vasculature but Mr. Looby says he sees a clear path to peripheral vasculature. “Lower extremity imaging is rapidly growing plus below the knee is a blue ocean space for us along with drug elution and bioresorbable platforms which would benefit from OCT guidance due to plaque morphology and device composition,” he says.

Mr. Looby outlines that Conavi has an exceptionally talented team of engineers, scientists, and clinicians dedicated to improving patient outcomes and reducing healthcare costs. As a medical device leader himself, with more than 25 years of experience launching and scaling innovative products, Mr. Looby has played a crucial role in the sale of two companies and the acquisition and integration of four others, creating significant value for shareholders and stakeholders. He has also established global market presence for several companies across the Americas, Asia, Europe, Africa, and the Middle East.

“We have an exciting roadmap and a strong management team that has attracted a remarkable board with a track record of 10+ exits totalling $2.5 billion consisting of medical device business and finance leaders plus interventional cardiologists from leading hospitals,” he adds.

“And, since Novasight is the only hybrid imaging system globally to deploy two well-accepted imaging modalities using a single catheter, we are distinctly differentiated and competitive in the market,” Mr. Looby says.

• • • • •

To connect with Conavi Medical or any other companies featured on BioTuesdays, send us an email at [email protected].