By Melane Sampson

Conavi Medical’s reverse merger with Titan Medical (TSX:TMD; OTC:TMDIF), which is expected to close in July 2024, and concurrent financing are anticipated to cultivate an investor network to help fund the expansion of the Novasight Hybrid System, a breakthrough imaging platform for use by interventional cardiologists during common minimally invasive heart procedures.

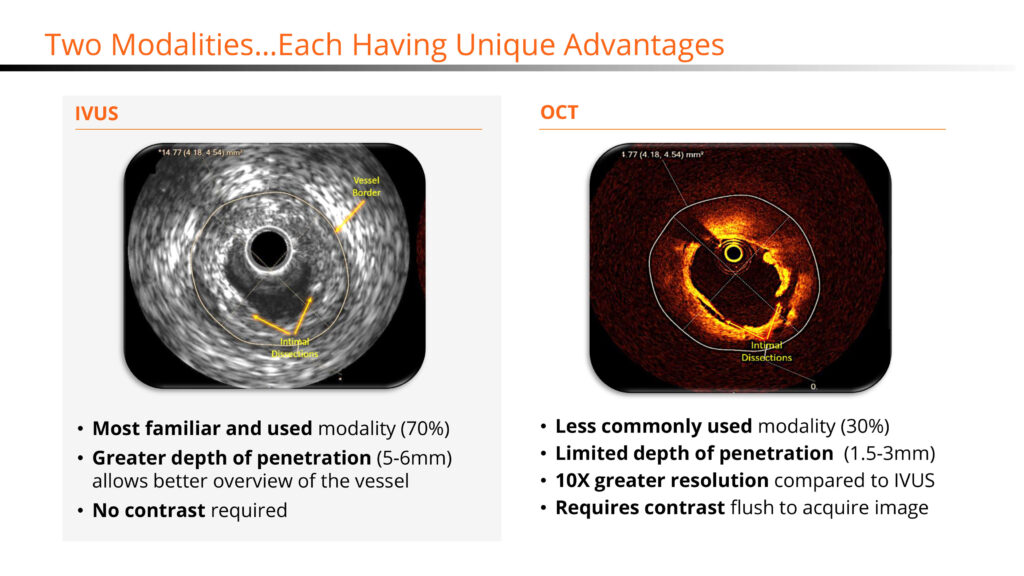

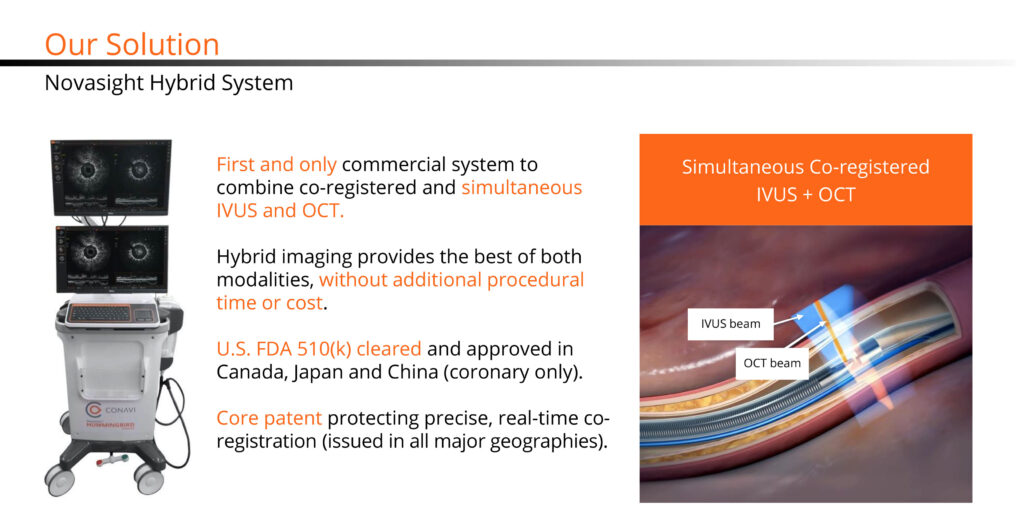

“Conavi’s Novasight Hybrid System is the first of its kind enabling simultaneous intravascular ultrasound (IVUS) and optical coherence tomography (OCT) imaging of coronary arteries with a single catheter,” Thomas Looby, CEO of Conavi Medical, says in an interview with BioTuesdays.

Mr. Looby explains that Novasight’s patented imaging system is co-registered, meaning the IVUS and OCT beams physically overlap so that the same cross-sections of tissue are imaged simultaneously with both modalities in a single imaging run.

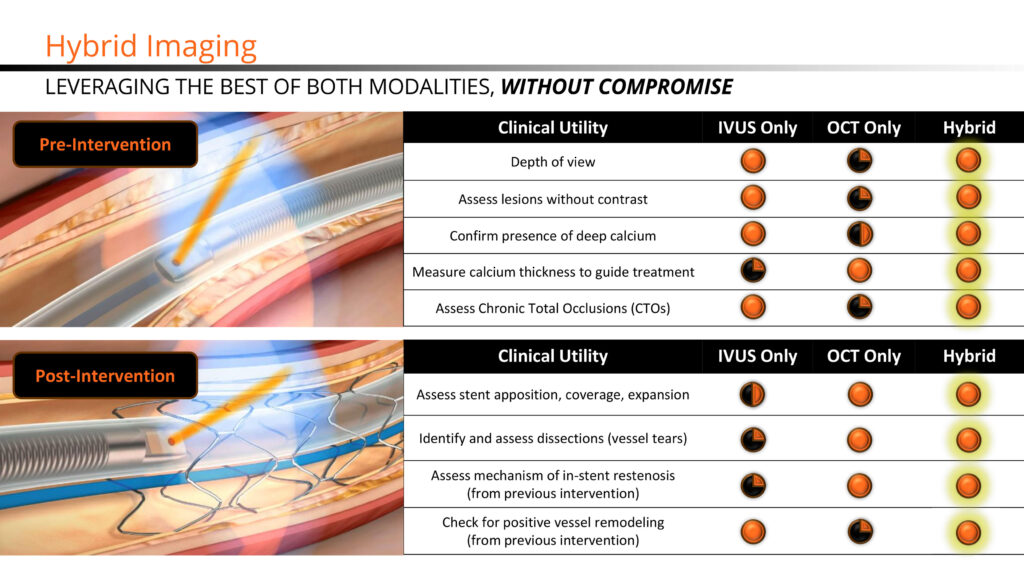

“IVUS and OCT each have their own unique advantages, with IVUS allowing for reduction in contract dye usage and greater depth of penetration and OCT delivering higher resolution images for enhanced visualization of the artery lumen and assessment of calcium thickness,” he adds.

The planned merger comes at a pivotal moment in the evolution of Conavi, Mr. Looby suggests, positioning the company as a publicly-listed, commercial-stage leader in hybrid intravascular imaging as it continues to advance Novasight as the first and only commercially available system that combines the penetration and blood field compatibility of sound waves with the resolution and lumen detail of infrared light.

“Novasight is truly groundbreaking technology enabling physicians to see inside coronary arteries during percutaneous coronary interventions (PCIs) versus the traditional angiography (x-rays) modality where visualization is limited to blood flow and interpretation can often be ambiguous,” he adds.

Each year, more than four million coronary angioplasty and stenting procedures are performed globally with the majority of PCIs using angiography only. However, Mr. Looby maintains that the adoption of newer intravascular imaging technologies, such as IVUS and OCT, is rapidly growing as a result of overwhelming clinical evidence in support of imaging to improve patient outcomes.

“We are very excited about this growth as the market has been developed by some pretty big players who have funded studies with compelling results that are driving the acceptance and adoption of image-guided versus angiography alone PCI procedures,” he says.

Mr. Looby points out that in August 2023, the European Society of Cardiology announced findings from 20 randomized, controlled trials of intravascular imaging-guided PCI compared with angiography-guided PCI in 12,428 patients with chronic and acute coronary syndromes. These studies showed improved outcomes with intravascular imaging compared with angiography, reporting a 20% reduction in cardiac death, 46% reduction in target vessel myocardial infarction, 52% reduction in stent thrombosis, and a 29% reduction in reintervention.

The Novasight Hybrid System has 510(k) clearance from the U.S. Food and Drug Administration and regulatory approval for clinical use from Health Canada, China’s National Medical Products Administration, and Japan’s Ministry of Health, Labor and Welfare.

“Our value proposition is that Novasight gives physicians the versatility of IVUS and OCT in one catheter and one mobile console while offering providers a cost-effective and space-saving solution at a comparable, single-use catheter cost,” Mr. Looby says. “There is no question in our minds that the future lies in image-guided interventions,” he adds.

The American College of Cardiology Interventional Council strongly suggests that intracoronary imaging should be a routine part of clinical practice as it serves to assess the lesion before intervention, prepare it for stent deployment, and assess how well the stent was placed.

Health economics are also expected to drive new cardiology guidelines and reimbursement. For example, Mr. Looby informs that the incremental cost-effectiveness ratio of IVUS, compared with angio-guided PCIs per quality-adjusted life year gained, has been shown to be $8,232 for complex PCIs and $12,730 for noncomplex PCIs.

Although currently a class 2a guideline, he adds that given the mounting evidence and strong industry support, a class 1 recommendation could soon be made for image-guided PCIs.

“Moreover, medical students are now being trained in an imaging-first approach which will eliminate the need for additional education and reduce the learning curve for interpreting intravascular imaging IVUS and OCT images,” Mr. Looby contends. “Novasight, having both IVUS and OCT images side-by-side is also uniquely suited for aiding in this image interpretation education at teaching hospitals as proficiency in IVUS and OCT translates directly to its use.”

The current PCI market stands at more than $700 million with the total available market valued at approximately $4 billion globally. “The intravascular imaging market has significant revenue growth potential as IVI methods advance and adoption among physicians continues to increase,” he adds.

Mr. Looby outlines that Novasight is a razor/razor blade business model similar to industry leaders such as Abbott, Philips and Boston Scientific. Pricing for the Novasight console and single-use catheter is comparable to standalone IVUS or OCT offerings, although, there may be an opportunity to justify a premium in the future.

Looking forward, Mr. Looby notes that gaining access to the public capital markets through the strategic amalgamation with Titan Medical will enhance Conavi’s financial strength and fuel its growth strategy, enabling it to unlock the full potential of its Novasight hybrid imaging technology in the United States and globally.

Mr. Looby highlights the company’s phased commercial roll-out with the pilot launch of Novasight 2.0 in the U.S. and the completion of Novasight 3.0 development in 2024 and 2025. “We will be launching Novasight 3.0 globally in early 2026 with ongoing clinical trials into 2027 to validate clinical utility for key applications.”

Currently, Novasight is approved for coronary vasculature but Mr. Looby says he sees a clear path to peripheral vasculature as well. “Lower extremity imaging is rapidly growing plus below the knee is a blue ocean space for us along with drug elution and bioresorbable platforms which would uniquely benefit from OCT guidance due to plaque morphology and device composition,” he says.

“We have an exciting roadmap and a strong management team that has attracted an exceptional board with a track record of 10+ exits totalling $2.5 billion consisting of medical device business and finance leaders plus interventional cardiologists from leading hospitals,” Mr. Looby says.

“And, since Novasight is the only hybrid imaging system globally to deploy two well-accepted imaging modalities using a single catheter, we are highly differentiated and competitive in the market,” he adds.

• • • • •

To connect with Conavi Medical or any other companies featured on BioTuesdays, send us an email at [email protected].

Editor’s Note: This article does not constitute an offer to sell or the solicitation of an offer to buy any securities of Conavi or Titan Medical, and shall not constitute an offer, solicitation or sale of any security in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.